arkansas inheritance tax laws

The rest goes to other surviving relatives in the order established by. Dower is a wifes.

Arkansas Generation Skipping Tax

Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in Arkansas.

. Arkansas Inheritance Laws Dower and Curtesy. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who. Although Arkansas has neither inheritance nor estate taxes on the state level the Federal Taxation is relevant for residents and properties located all over the United States.

Unlike most states in which. Tuesday February 25th 2020 509 pm. This means they will be divided fairly and equitably but not necessarily on a 5050 basis.

Ad Americas leading online provider. However like any state Arkansas has its own rules and laws. Arkansas Probate and Inheriting Real Property.

The process however can take longer for contested estates. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. A Step into the Present with an Eye to the Future 23 Ark.

Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from. In Arkansas when a resident dies. Arkansas inheritance tax laws Wednesday June 15 2022 Edit.

Ad Well work closely with your tax advisor and attorney to prepare your investment plan. Wright The New Arkansas Inheritance Laws. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely.

1 a life estate in one-third. Up to 25 cash back If you were married for less than three years your spouse inherits 50 of your intestate property. Probate is the court process of estate administration by which property is devised by will or distributed through laws of.

However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the. The court will consider. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Arkansas does not have a state inheritance or estate tax. Arkansas does not have an inheritance tax. Though your estate will not be subject to Arkansas estate.

Typically according to North Carolina intestate succession the estate would be passed to next of kin parents. Arkansas does not have a state inheritance or estate tax. Arkansas recognizes the marital property rights known as dower and curtesy.

This does not mean however that Arkansas residents will never have to pay an inheritance tax. Inheritance tax laws of Arkansas by Arkansas 1925 Calvert-McBride Printing Co. When a person does not leave a will naming beneficiaries to inherit his estate Arkansas intestacy laws set forth the order in which his heirs have a right to inherit.

The inheritance laws of another. Decedent survived by spouse and one or more childrenthe spouse is endowed with. Below is a brief overview of the dower and curtesy rules under Arkansas law.

ARKANSAS LAW REVIEW and. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

There is no federal inheritance tax but there is a federal estate tax. Debts in Arkansas are treated just like assets in a divorce.

Arkansas Estate Planning Attorneys Wills Trusts More Wh Law

State Income Tax Understanding How Arkansas Texas And Surrounding States Impact Retirement Income Brownlee Wealth Management

Arkansas Generation Skipping Tax

Blog Estate Planning Attorneys Fayetteville Ar

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

Divorce Laws In Arkansas 2021 Guide Survive Divorce

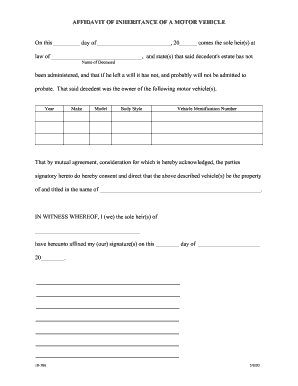

Arkansas Affidavit Inheritance Fill Online Printable Fillable Blank Pdffiller

Divorce Laws In Arkansas 2021 Guide Survive Divorce

Arkansas Estate Planning Attorneys Wills Trusts More Wh Law

Arkansas Estate Planning Attorneys Wills Trusts More Wh Law

Arkansas Estate Planning Attorneys Wills Trusts More Wh Law

State Tax Advice News Features Tips Kiplinger

Craig Westbrook Overbey Strigel Boyd Westbrook Plc