cap and trade vs carbon tax canada

Carbon Tax vs. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so.

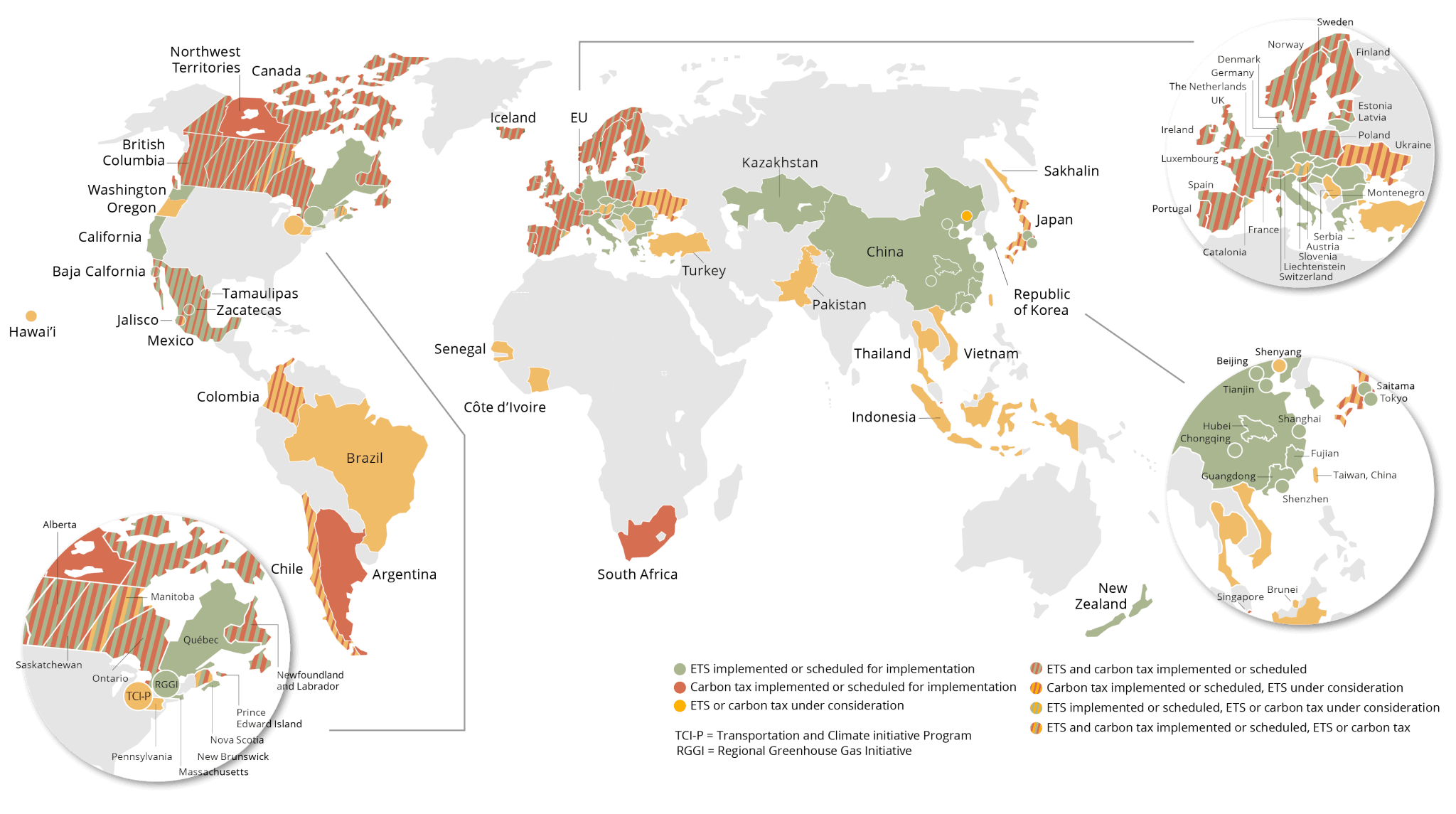

Where Carbon Is Taxed Overview

Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at.

. Two types of tokens poker chips pieces of candy board game pieces etc. Californias cap and trade system provides additional relief to sectors at high risk of carbon leakage and with more than 50 process emissions. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a.

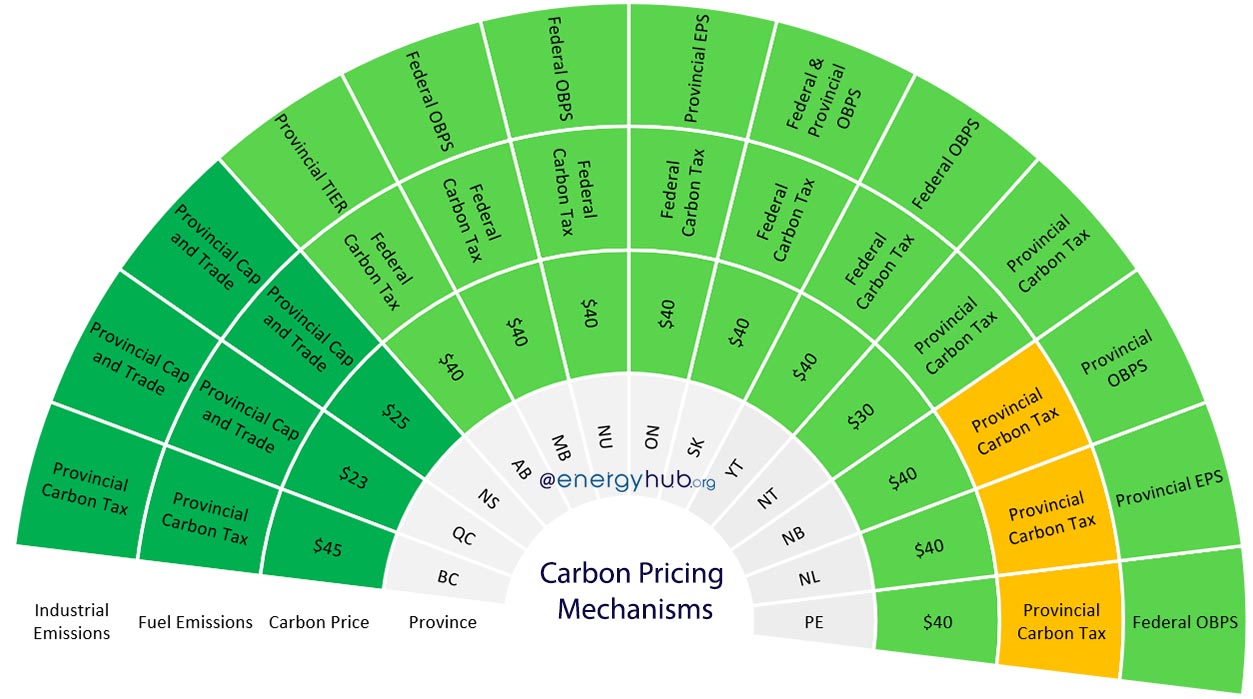

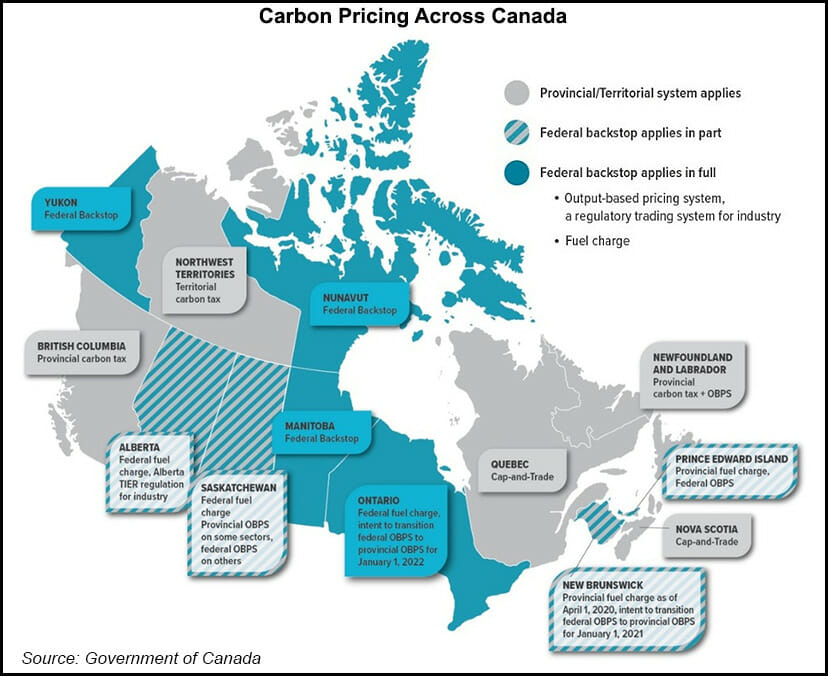

5 another recent government commitment to carbon pricing is the ontario governments decision to institute a cap and trade system effective january 1 2017. Quebecs cap and trade system provides 100 relief to process emissions. More about this program.

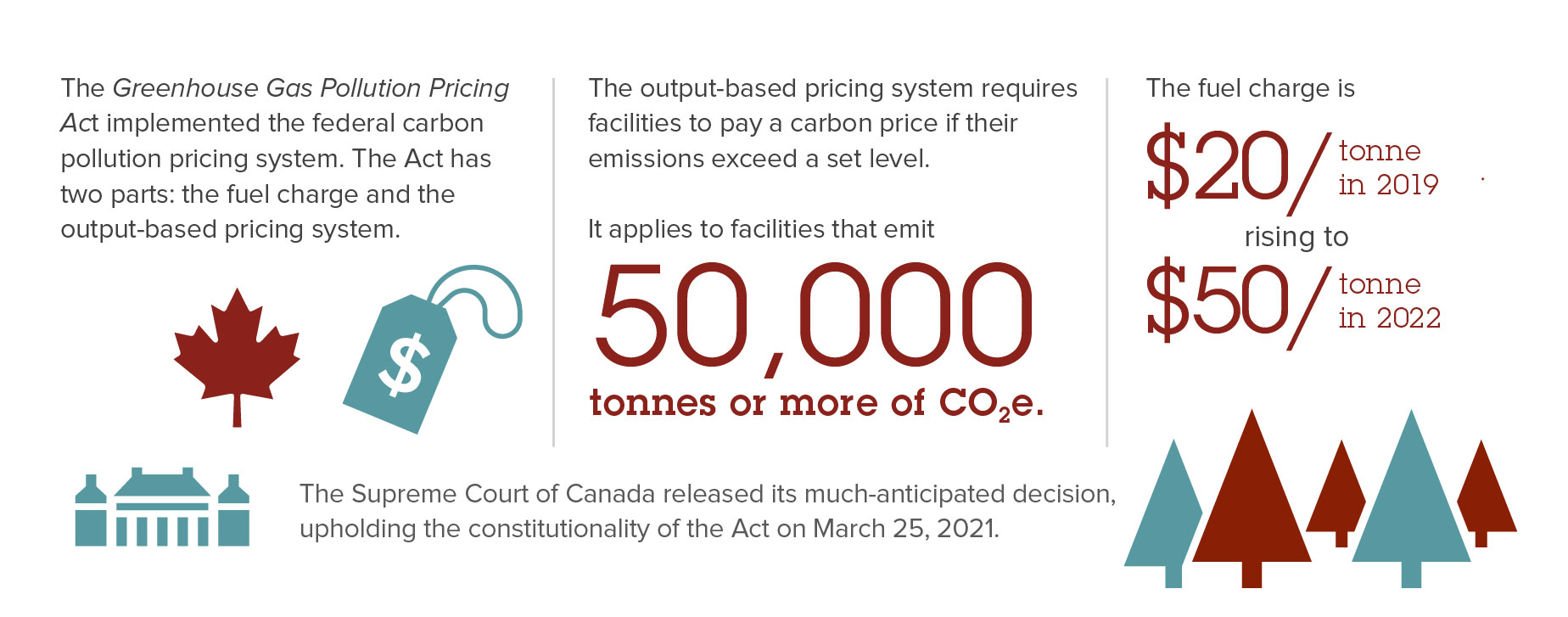

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Theory and practice Robert N. Starting in 2021 process emissions will be subject to a tightening rate of 05 per year.

Meanwhile the states economy is thriving PDF. Joe wasnt defending cap-and-trade as such against the carbon tax alternative -- he was defending Waxman-Markey including all its complementary policies against the tax alternative Ryan Avent says taxes and caps are not that different in effect and only one has a chance of passing so carbon taxers should STFU. With a cap and trade scenario emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own.

A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. A carbon tax and cap-and-trade system complement each other ensuring there is a price on CO2 emissions across the entire economy given that a cap-and-trade system typically covers large stationary sources of emission at the production end while a carbon tax addresses the consumption end. In the provincial scenario a legislature will set an emissions cap a set tonnage that individual emitters must stay under.

Carbon Tax vs. In a carbon tax scenario emitters must pay for every ton of GHG they emit - thereby creating an incentive to reduce emissions in the house as much as possible to avoid the tax burden. Cap and trade makes even deeper cuts possible when countries cooperate such as the United States and Canada.

Another implication with the imposition of a carbon tax or cap and trade system is that depending on the industry specialization of the country it can result in primarily hurting the industries that are key actors in the local economy. This tax will then increase by 10tonne every year until it reaches 50tonne in 2022. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions.

Each approach has its vocal supporters. In Quebec and Nova Scotia the governments cap the amount of emissions theyll allow each year then hold quarterly auctions so companies can buy emissions credits within that amount. The cap and trade system is thus functionally similar to a tax on carbon.

They lean toward a cap-and-trade system which would set a limit on carbon-dioxide emissions and require companies to obtain permits to release. April 9 2007 413 pm ET. Under a cap-and-trade system governments impose a strict quota or cap on the overall level of carbon pollution that can be generated.

British Columbia for instance has its own higher carbon tax in place which rose to 30 per ton this year and Quebec has enacted a local cap-and-trade system. Cap and trade. In 2017 cap and trade will cost the average ontario household about 13 more per month to fuel a car and heat a home.

Cap and Trade vs. The Cap-and-Trade Program is a key element of Californias strategy to reduce greenhouse gas emissions. It complements other measures to ensure that California cost-effectively meets its goals for greenhouse gas emissions reductions.

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. A cap may be the preferable policy when a jurisdiction has a specified. Currently British Columbia and Alberta have a carbon tax whereas Quebec and Ontario has a cap-and-trade system 5 things to know about Canadas carbon pricing plans 2016.

Peter MacdiarmidGetty Images G r. List mechanisms that limit externalities through a a carbon tax and b a cap and trade system and describe the effects of these mechanisms on trade. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

Deck of standard 52 cards. Cap and trade differs from a tax in that it provides a high level of certainty about future emissions but not about the price of those emissions carbon taxes do the inverse. Cap and trade allows the market to determine a price on carbon and that price drives investment decisions and spurs market innovation.

A cap-and-trade system meanwhile is a market-based approach to controlling carbon emissions. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. Californias emissions from sources subject to the cap declined 10 between the programs launch in 2013 and 2018.

Carbon taxes vs. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. The cap typically decreases each year to.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. With the carbon tax system a cost is placed on pollution. A carbon tax and cap-and-trade are opposite sides of the same coin.

Cap and Trade.

The Carbon Tax For Dummies Why Do We Need It And What Will We Pay Greenhouse Gases Energy Conservation Greenhouse Gas Emissions

Opinion Why A Carbon Tax Won T Solve Climate Change Climate Change Climate Change Debate Human Behavior

Climate Change Not Looking So Hopeless A Map Of Climate Change Policies Around The World Link To Pdf Of Source Report In Comments Climate Change Policy Climate Change Climate Policy

Canadian Carbon Prices Rebates Updated 2021

Green City Times Carbon Cap And Trade Putting A Price On Carbon Cap And Trade Climate Reality Climate Adaptation

Antarctica Effects Of Global Warming Global Warming Antarctica

Archive World Bank Group President Jim Yong Kim On Twitter Cap And Trade Climate Reality Climate Adaptation

Our Energy Transition Away From Fossil Fuels Solar Energy Business Solar Energy Renewable Energy

Where Carbon Is Taxed Overview

Carbon Pricing Vs Carbon Tax Understanding The Difference 2021 04 14 Engineered Systems Magazine

44 Ccl Carbon Fee Tax And Dividend Jobs Youtube Dividend Job Carbon

Ted Nugent Tells Tucker Tyrants Can Kiss His A Youtube Kissing Him Ted Tucker

The Ief Is Creating A New Methodology For Quantifying Emissions From The Energy Industry Its Chief Economist Tells Ngw In A Methane Online Publications Gas

Federal Government S Carbon And Greenhouse Gas Legislation Canada

Cap And Trade Basics Center For Climate And Energy Solutions

Where Carbon Is Taxed Overview

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence